Buying my house was stressful.

I was 24 years old, recently single, and had no idea what I was getting into.

- I knew I wanted my own place.

- I knew I wanted to live in downtown Hamilton.

- I didn’t know about bidding wars.

- I didn’t know about financing options and when it came to finalizing the deal, I was screwed because I didn’t know anything about the house I had just bought!

In 2016 when I bought my house in Hamilton Ontario, there were bidding wars on every home. I had two previous offers fall through so I did not include a home inspection condition on the house I ended up buying. That means I didn’t have a professional look over my house before I bought it. Eeek!

When it came time to meet with my lawyer to finalize the details, his office told me to come prepared with my insurance documents.

NEWS FLASH! I didn’t have insurance yet so I frantically emailed people for quotes. Finding insurance for the house was one of the most stressful parts of the entire home buying process. Every agency asked for a ton of details that I didn’t have. They wanted to know

- the age of the house

- type of construction

- the kind of piping, windows, electrical wiring, basement, and shingles it had

- and SO much more!

In an effort to save you from unnecessary stress, here are 3 things that I wish I knew about home insurance when I bought my first house.

Know the age of your home

This may seem like common sense now, but I was in a pickle. The first obstacle I faced after I bought my place was that nobody knew the age of this damn house! I found 3 different dates, scoured the library records, called up my agent to search different databases, and eventually, it was determined it was over 100 years old. The age of a house can affect the insurance quote so this is one thing you absolutely need to know before you get home insurance.

Know what your house is made of

The second obstacle was that I didn’t know anything about construction, shingles, plumbing, wiring, or anything! When I came across Square One insurance, they made the process so simple… and I did it all online!

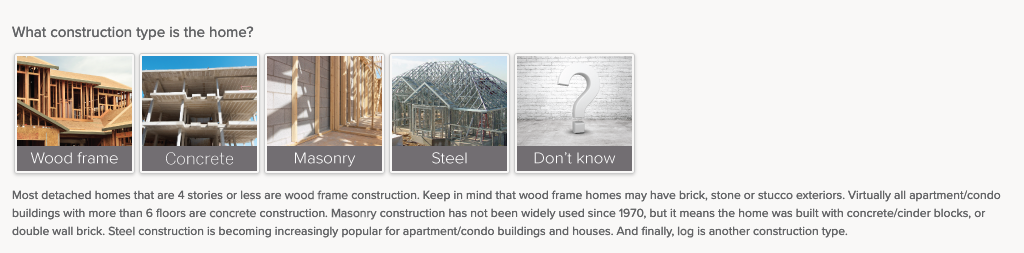

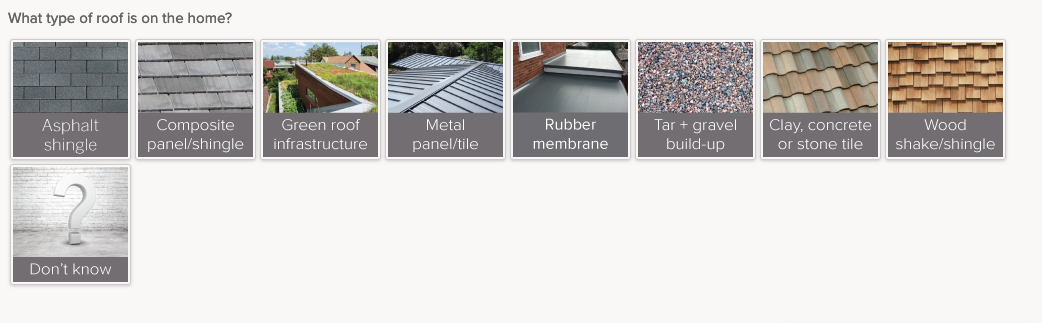

Square One insurance had great customer support and their application process shows you different visual options. All you do is click on the option that reflects your house. If you don’t know the answer just take a picture of the feature and send it to them.

Here are screenshots of the SquareOne Insurance application process.

Choose an insurance that offers you piece of mind

Square One Insurance Services makes the home insurance process effortless. They have an experienced team, genuine service, and excellent prices. I haven’t had to make a claim yet but the entire application process with Square One Insurance was less stressful because they were so helpful.

Here are some other reasons I recommend Square One Insurance:

- User-friendly and millennial-friendly application process

- Good phone support

- Pay monthly with no interest charges

- Policy is emailed to you

- No long-term contracts, cancel at any time with no penalty

- Manage your policy online or by phone at any time (for free)

- Policy documents are super easy to understand

- Pay only what you need

Want to try Square One Insurance Services? Visit their website today.